capital gains tax changes 2021

HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential. Ad Get Help With Your Tax Litigation Case From The Tax Experts at David Lee Rice.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

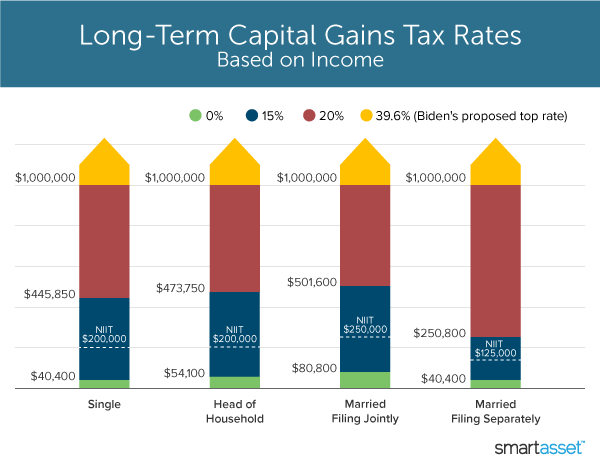

. Since 1 July 2021 capital gains tax CGT does not apply when a granny flat arrangement is created varied or terminated. Long-term gains still get taxed at rates of 0 15 or 20. The current capital gain tax rate for wealthy investors is 20.

Corporate income and the treatment of carried interests. If you have a 500000 portfolio be prepared to have enough income for your retirement. Hundred dollar bills with the words Tax Hikes getty.

The current capital gain tax rate for wealthy investors is 20. Here are 10 things to know. The proposal would increase the maximum stated capital gain rate from 20 to 25.

The following are some of the specific exclusions. Add this to your taxable. We understand the tax code so you dont have to.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. The effective date for this increase would be September 13 2021. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

And a significant increase in the tax rate on. Events that trigger a disposal include a sale donation exchange loss death and emigration. Issues covered include capital gains tax rates tax rates and rules for pass-through vs.

Ad Get Help With Your Tax Litigation Case From The Tax Experts at David Lee Rice. Up to 10 cash back The Inflation Reduction Act of 2022 provides investment in clean energy promotes reductions in carbon emissions and extends popular Affordable. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. That rate hike amounts to a staggering 82. Separation and Divorce detailing the changes to the rules applicable to.

The Biden Administration Tax Proposals. The 238 rate may go to 434 for some. Ad Download The 15-Minute Retirement Plan by Fisher Investments.

Ad If youre one of the millions of Americans who invested in stocks. In 2018 the IRS condensed. The government has released law Project and an attendant guidance document Capital Gains Tax.

In April 2021 the president addressed the public with a speech and subsequent fact sheet outlining his proposed American Families Plan. First deduct the Capital Gains tax-free allowance from your taxable gain. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. The new top rate combined with an existing 38 surtax on investment income over.

Investors Relief which applies to gains made on the disposal of investments in ordinary shares may come to an end effectively cutting the Capital Gains Tax by 50 to 10. A granny flat agreement is a written agreement that gives an. Because you only include onehalf of the capital gains from these properties in your taxable.

Get A Resolution for Your Tax Case with The Law Office of David Lee Rice. Weve got all the 2021 and 2022 capital gains. Tax Season 2021 has begun.

Capital Gains Tax changes that Self Assessment customers need to know. Biden is proposing that Congress raise the top tax rate on capital gains from 20 to 396. Ad Serving all 50 states and the IRS our tax lawyers will work quickly and efficiently.

Long-term gains still get taxed at rates of 0 15 or 20. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. When you dig into your tax return for reporting 2020 income youll notice that Form 1040 has changed yet again.

Get A Resolution for Your Tax Case with The Law Office of David Lee Rice. The Biden administration will likely need to pair an expected capital gains rate hike on the wealthy with a major tax change related to lifes other certainty.

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Capital Gains Tax What It Is How It Works Seeking Alpha

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Tax Changes And Key Amounts For The 2022 Tax Year Kiplinger

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

What You Need To Know About Capital Gains Tax

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Canada Capital Gains Tax Calculator 2022

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2022 Capital Gains Tax Rates In Europe Tax Foundation

What You Need To Know About Capital Gains Tax

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Difference Between Income Tax And Capital Gains Tax Difference Between

What S In Biden S Capital Gains Tax Plan Smartasset

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)